Welcome and Introduction

Welcome to Bhurtun School of Taxation (BST).

Founded in 2021, BST has rapidly established itself as a leading provider of dynamic and interactive training programs in taxation and corporate law.

BST’s mission is to equip individuals with the practical knowledge and applied skills needed to excel in the complex world of business, finance, and corporate compliance.

Since its inception, BST has consistently delivered training programs in small, focused groups, ensuring personalised attention, optimal engagement, and meaningful interaction between trainers and students. Through case studies and real-world applications, BST offers an immersive learning experience that builds both technical competence and professional confidence.

In line with its commitment to developing future finance professionals, BST is pleased to introduce its new ACCA tuition program designed to provide a comprehensive and structured learning pathway for students beginning their accountancy careers. This program combines expert-led instruction, flexible hybrid learning, and practical exam preparation, equipping students with the skills, confidence, and support needed to succeed in their ACCA journey.

With our program, students will benefit from:

- Hybrid classes: Attend online live sessions or in-person at our centre.

- Structured syllabus coverage aligned with ACCA Global Standards.

- Study support and resources, including recordings, question banks, and mock exams.

- Flexible study hours designed to suit working professionals and full-time students.

- Guidance and mentoring, helping each student tract progress and prepare effectively for exams.

This program is ideal for anyone seeking to start a career in accounting and build a solid foundation for progression in the ACCA qualification.

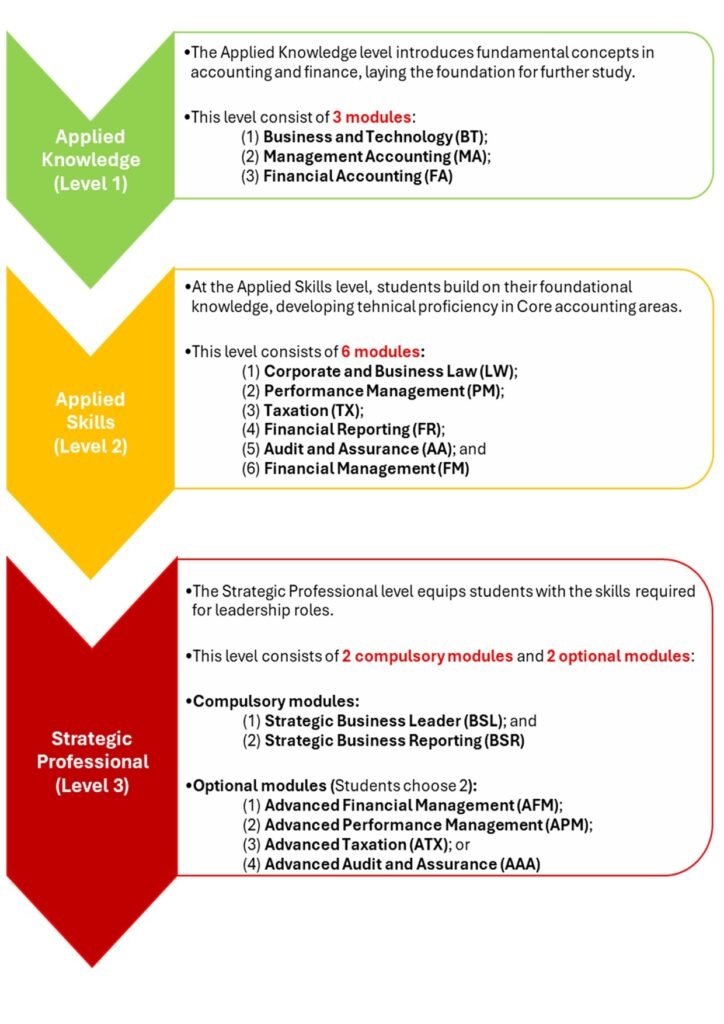

Pathway Overview

*BST offers tuition in Levels 1 & 2 ONLY, i.e. Applied Knowledge and Applied Skills

Level 1: Applied Knowledge

Entry requirements:

General entry requirements (see below).

Topics covered:

Module | Topics |

Business & Technology (BT) | Topic 1 – Training & Development Topic 2 – Personal effectiveness. Performance appraisal. Topic 3 – Leading People. Individuals and teams. Topic 4 – Motivation. The role of accounting. Micro-economics. Topic 5 – Macro-economics. Business environment. Business organisation. Topic 6 – Organisational culture. Corporate governance. Ethics. Topic 7 – Information systems. Control and security. Fraud. Revision |

Management Accounting (MA) | Topic 1 – Introduction to Cost Accounting; Cost Classification and Behaviour. Topic 2 – Materials, labour and Overheads. Topic 3 – Overheads and Absorption Costing and Cost bookkeeping. Topic 4 – Absorption v/s Marginal Costing. Job Costing. Topic 5 – Job, Batch and Service Costing (continued). Process Costing. Topic 6 – Budgeting and Introduction to Statistical Techniques. Topic 7 – Advanced Statistical Techniques. Topic 8 – Investment Appraisal. Topic 9 – Standard Costing and Variance Analysis. Topic 10 – Performance Measurement (Financial Performance). Revision. |

Financial Accounting (FA) | Topic 1 – Introduction to Accounting and Double Entry. Topic 2 – Adjustments to Financial Statements. Topic 3 – Non-current Assets. Topic 4 – Accruals and Prepayments. Topic 5 – Maintaining records for Customers and Suppliers. Topic 6 – The Correction of Errors and Bank Reconciliation Statements. Topic 7 – Process of Accounting for Limited Companies. Topic 8 – Accounting Standards. Topic 9 – Cash Flow Statements. Topic 10 – Interpretation of Accounts. Topic 11 – Introduction to Group Accounting. Revision |

Study Mode:

Hybrid delivery (online + in-person)

Duration:

8 to 10 weeks per module

Other class features:

- Interactive hybrid classes

- Weekly assessments

- Mock exams and tutor feedback

- Study materials and question banks

- Guidance on ACCA computer-based exams (CBE)

Fees & Payment Plan:

Option | Description | Amount (MUR) |

Full Payment | Per Module | 8,000 |

2 Instalments | 60% upfront, 40% mid-course | 8,500 |

Level 2: Applied Skills

Entry requirements:

- General entry requirements (see below).

- Students who have completed level 1.

Topics covered:

Module | Topics |

Corporate and Business Law (LW) | Topic 1 – The English Legal System. Topic 2 – Contract – formation. Topic 3 – Contract – terms, breach. Topic 4 – Tort law. Employment, Introduction to Agency & Partnership. Topic 5 – Partnership. Topic 6 – Company Law (Legal personality & company formation, Share capital, Loan capital, Meetings & resolution). Topic 7 – Company Law (Directors, Meetings & resolutions, other officers, Insolvency) Topic 8 – Fraudulent behaviour Revision. |

Performance Management (PM) | Topic 1 – Overview of information systems. Costing methods. Topic 2 – Costing methods. Topic 3 – Short-term decision making (many topics fall under this heading: relevant costing, further processing, make or buy decision, limiting factor analysis, linear programming). Topic 4 – Short-term decision making (CVP analysis). Pricing. Topic 5 – Decisions under uncertainty. Budgeting. Topic 6 – Budgeting (learning curves). Advanced variances. Topic 7 – Financial and non-financial performance evaluation. Topic 8 – Divisional performance and transfer pricing. Revision. |

Taxation (TX) | Topic 1 – Fundamentals of taxation and the basics of corporate tax. Topic 2 – Corporate tax, treatment of a company’s loss and Groups. Topic 3 – Personal tax computation, Employment Income and NICs. Topic 4 – Trading profits, the basis of assessment and Partnerships. Topic 5 – Fundamentals of chargeable gains. Topic 6 – Chargeable gains: partial disposals, reliefs and exemptions. Topic 7 – Fundamental of inheritance tax and lifetime transfers. Topic 8 – Inheritance tax: death estate and VAT Revision. |

Financial Reporting (FR) | Topic 1 – Consolidated Statement of Financial Position. Topic 2 – Consolidated Statement of Profit or Loss, and Associates. Topic 3 – Published Accounts – Introduction, and Non-current Assets. Topic 4 – Impairment of assets and Leasing. Topic 5 – Revenue, Contracts and Assets held for sale. Topic 6 – Taxation adjustments and Provisions & Contingencies. Topic 7 – Financial Instruments. Topic 8 – Earnings Per Share; Analysis and Interpretation. Revision. |

Audit & Assurance (AA) | Topic 1 – Essential Exam Technique for the AA paper. Topic 2 – Key Audit Concepts including Ethics. Topic 3 – Audit Planning including Risk. Topic 4 – Internal Controls in Audit. Topic 5 – Audit Evidence Principles. Topic 6 – Procedures. Topic 7 – Finalisation of the Audit and Audit Report. Topic 8 – Internal Audit. Revision. |

Financial Management (FM) | Topic 1 – Introduction to Financial Management and Investment Appraisal Techniques. Topic 2 – Advanced Investment Appraisal. Topic 3 – Sources of Finance and Cost of Capital. Topic 4 – Unit Structure and Financial Performance. Topic 5 – Raising Equity Finance and Financial Performance Measures. Topic 6 – Risk. Topic 7 – Working Capital Management. Revision |

Study Mode:

Hybrid delivery (online + in-person)

Duration:

10 to 12 weeks per module

Other class features:

- Interactive hybrid classes

- Weekly assessments

- Mock exams and tutor feedback

- Study materials and question banks

- Guidance on ACCA computer-based exams (CBE)

Fees & Payment Plan:

Option | Description | Amount (MUR) |

Full Payment | Per Module | 12,000 |

2 Instalments | 60% upfront, 40% mid-course | 12,500 |

General Entry requirements

Minimum Entry requirements:

- 2 A-levels and 3 GCSEs or equivalent in 5 subjects, including English and Mathematics.

- English Proficiency.

- Must be 18 or over.

- We advise you to check your starting point with ACCA before enrolling on the Course as you may qualify for exemptions.

Exam Information

- Maximum of 2 exams to be taken in one sitting.

- Students have 10 years to pass all the examinations on the ACCA exams list. They have 7 years to pass the exams at the Professional level (SBL and SBR and 2 options exams AFM – AAA). The 7-year time limit starts when a student passes their first Professional-level exam.

- The pass mark for all examinations is 50%

- In addition to the 13 ACCA exams, students must study an online module in Professional Ethics. It is recommended that this is studied at the same time as SBL.

Payment and Pricing Terms

- Fees are indicative and are subject to change.

- Payment options: Full payment or instalments.

- Fees do not include ACCA registration, subscription, or exam entry fees.

Enrolment Information

Pre-enrolment Information:

Technical requirements:

- It is advisable that students install Microsoft Office on their computers as tutors ay provide additional downloadable notes in Doc, XLSX, PPT and PDF formats.

- Recommended internet browsers: Google Chrome, Firefox, or Microsoft Edge.

- Recommended minimum internet speed: 512 kbps

Access to materials during the Course:

- Access to all learning materials and live sessions opens in the month of intake and closes 3 months later. For example, if teaching starts in mid-June, access will stop in mid-September after the exams. Students taking Computer-Based Assessments (CBE) have access for 6 months.

Learning materials consist of the following:

- Live tuition and revision sessions

- Recorded live tuition and revision sessions.

- Study manuals, question banks, class, and revision notes.

- Other relevant materials tutors may provide.

Timetable:

- All classes are taught in the evening (MRU Time), Monday to Thursday. Classes typically start at 6:30 PM and end at 8:30 PM, and revision ends at 9 PM.

- BST also provides a mentoring hour in the evenings for all students. During mentoring hours, tutors marks students’ homework and speak to students directly about any concerns.

- Usually, there are 8 weeks of live online tuition (Some course have up to 2 extra sessions) and 4 weeks of live online revision.

For Computer-Based Examinations (CBE):

- Business Technology – 8 Weeks

- Corporate and Business Law – 10 Weeks

- Management Accounting – 11 Weeks

- Financial Accounting – 12 Weeks.

- Face-to-face revision is offered on 2 weekends. Students can join the session live online or watch the recording if they cannot attend.

Learning expectations:

- BST recommends that students allocate 9 hours of self-study per week in addition to live classes.

- You will be asked to complete homework in every tuition and revision session, which will be marked with feedback provided during your mentoring hour.

- You will also be asked to complete a time-limited exam in line with the ACCA papers list.

- BST expects students to attend all live sessions, but if that is not possible (e.g. time zone constraints), we ask that students utilise the recorded sessions. If you do not attend any live or recorded sessions, you may be removed from the course and deferred to the next session.

Practical Experience Requirement (PER):

- To become fully qualified accountants, students must gain practical experience during an ACCA programme.

- Students must take the Ethical and Professional Skills module and gain professional experience by spending 36 months in an accounting or finance-related role.

- Besides exam success, practical experience and knowledge of ethics enable you to become a successful accountant.

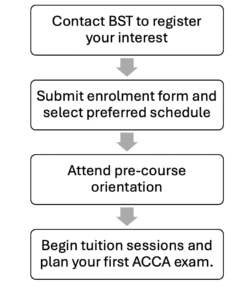

Enrolment Process

Contact Information

Bhurtun School of Taxation

Address: Ground Floor, Henessy Court, Port Louis, Mauritius

Tel: +230 260 60 30